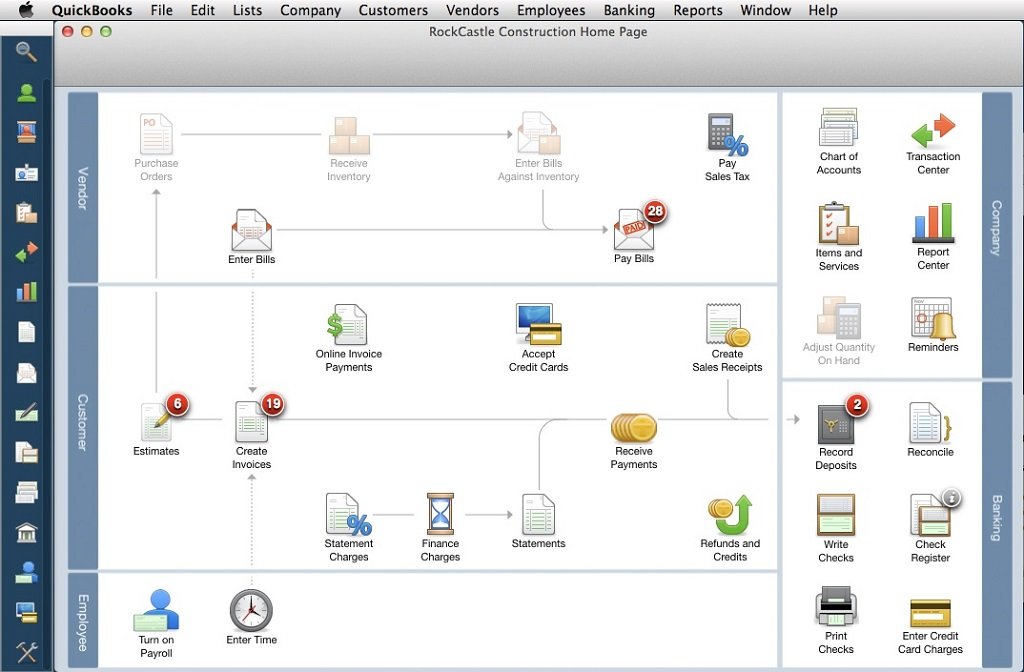

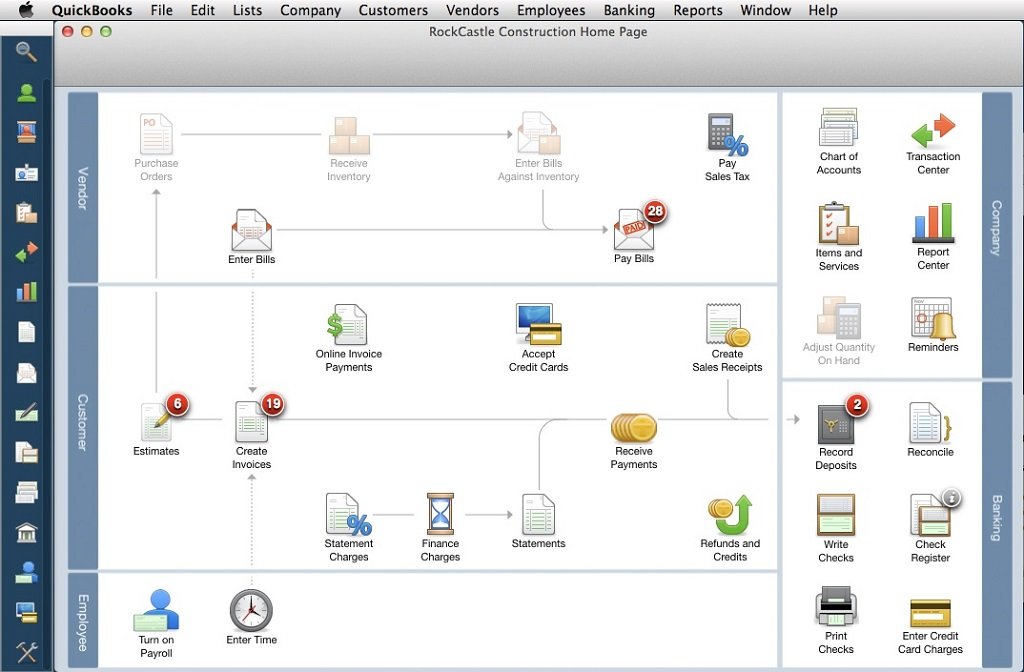

If the vendor billing information received and entered in QuickBooks includes charges or adjustments not entered on the original voucher in Point of Sale, such as a freight charges, discounts, or fees, there will be a difference between the documents in the two programs unless you also edit the voucher in Point of Sale to add these items. When the billing information is received from the vendor, enter it in QuickBooks and the Item Receipt is converted to a Vendor Bill in Accounts Payable.

All vouchers are sent immediately to QuickBooks as Item Receipts if you have chosen the Company preference in Point of Sale to send detailed item information to QuickBooks, the item receipts will contain the individual items.

The vendor billing fields (payee, terms, bill date, invoice/reference #) are NOT available on the receiving voucher form in Point of Sale. When this default preference is in force: If you prefer to handle all vendor billing tasks in QuickBooks financial software, rather than in Point of Sale, you should retain the default (unchecked) setting* found in Company Preferences for Receiving “Enter Vendor Billing Information in Point of Sale ” ( Shown above). Preference Settings and Financial Exchange of Receiving Vouchers When using QuickBooks Point of Sale you have two choices how Vendor Bills can be handled once you make your choice you should stick with that choice unless you are thoroughly aware of the necessary steps to make the change from both an operational and financial standpoint. In this case it appears that either the preference was initially set to one option, and then changed or that the staff was improperly instructed on how to properly post vendor billing information. This is not the first time the Data Detective has seen this situation he knows that it arises from how certain preferences are set, and perhaps changed in, QuickBooks Point of Sale. Further examination reveals that Vendor Bills have been entered and paid for amounts corresponding to almost every journal entry in the Unbilled Purchases account. Upon reviewing their data, our Sleuth quickly determines that the Unbilled Purchases account contains a significant number of journal entries that have never been cleared. They also are concerned by the fact that their Inventory Asset account seems too high in comparison to the value of their inventory listed in QuickBooks Point of Sale. A small retail store calls the Data Detective for help because the owner has noticed that their QuickBooks Balance Sheet contains a large amount under a current liability account called “Unbilled Purchases”.

The vendor billing fields (payee, terms, bill date, invoice/reference #) are NOT available on the receiving voucher form in Point of Sale. When this default preference is in force: If you prefer to handle all vendor billing tasks in QuickBooks financial software, rather than in Point of Sale, you should retain the default (unchecked) setting* found in Company Preferences for Receiving “Enter Vendor Billing Information in Point of Sale ” ( Shown above). Preference Settings and Financial Exchange of Receiving Vouchers When using QuickBooks Point of Sale you have two choices how Vendor Bills can be handled once you make your choice you should stick with that choice unless you are thoroughly aware of the necessary steps to make the change from both an operational and financial standpoint. In this case it appears that either the preference was initially set to one option, and then changed or that the staff was improperly instructed on how to properly post vendor billing information. This is not the first time the Data Detective has seen this situation he knows that it arises from how certain preferences are set, and perhaps changed in, QuickBooks Point of Sale. Further examination reveals that Vendor Bills have been entered and paid for amounts corresponding to almost every journal entry in the Unbilled Purchases account. Upon reviewing their data, our Sleuth quickly determines that the Unbilled Purchases account contains a significant number of journal entries that have never been cleared. They also are concerned by the fact that their Inventory Asset account seems too high in comparison to the value of their inventory listed in QuickBooks Point of Sale. A small retail store calls the Data Detective for help because the owner has noticed that their QuickBooks Balance Sheet contains a large amount under a current liability account called “Unbilled Purchases”.

0 kommentar(er)

0 kommentar(er)